15 Digital Marketing ROI Metrics You Need To Know

Digital marketing and its corresponding metrics of success and return on investment are evolving by leaps and bounds.

Over the past few years (especially due to COVID), it has been Switch to digital Accelerated years earlier than expected.

Any marketer who has ever immersed himself in the Google Analytics suite can attest that the sheer volume of data available can be overwhelming.

In order to cut through the noise and accurately measure the ROI of your digital marketing efforts, it’s important that you identify the key metrics you want to track.

In this article, you’ll find 15 essential metrics that will help you measure the return on investment of your digital marketing, tell you whether your efforts are working, and show you where adjustments may be needed.

What metrics help you measure the return on investment in digital marketing?

- Cost per lead (CPL).

- Lead closing rate.

- Cost per acquisition (CPA).

- Average Order Value (AOV).

- Conversion rates by channel.

- Conversion rates by device.

- exit rate.

- Blog click-through rates.

- Customer lifetime value (CLV).

- Net Promoter Score (NPS).

- Time invested in project/campaign vs returns.

- Traffic to lead ratio.

- Return on advertising spend (ROAS).

- Total revenue.

- Customer retention rate.

1. Cost per lead

If your website is collecting leads, you need to know how much you are paying for each lead.

If your cost per lead is more than what you produce by closing the leads, this indicates a lagging return on investment.

Knowing your cost per lead lets you know how well your marketing efforts are doing and gives you the insight you’ll need to make more budgetary and strategic decisions.

2. Closing lead price

How do you keep track of your lead closing?

Often, this happens offline which means that the data is not integrated into analytics or the online data you collect.

This is fine, but you need to make sure you monitor your lead close rate so you can check it against the leads that are being generated.

This will help ensure that your digital marketing efforts deliver profitable leads.

This information is also useful to use as a control against new digital marketing efforts.

If you suddenly receive an influx of new leads but find that they close at a lower rate, you may need to adjust your targeting efforts.

Measuring close rates also gives you insight into how sales teams and representatives close sales leads.

3. Cost per acquisition

Using the data above, you should now be able to figure out your CPA.

This can be found out simply by dividing your marketing costs by the number of sales generated.

You now know what it costs to get a sale, which will help you get a stronger understanding of your return on investment.

Many digital marketing leaders work on cost-per-acquisition (CPA) models because they only pay for leads or sales based on a set amount or goal.

This helps drive goals and convert them into predefined conversions or results.

4. Average order value

While you want to see your order count increase, paying attention to the average ticket value can reap big rewards.

AOV is a key metric that can help marketers track earnings and manage revenue growth and earnings reports.

A small increase in average order value can generate thousands of dollars in new revenue and can often be as simple as improving user experience and providing sales opportunities.

5. Conversion rates by channel

Integrated digital marketing strategies are now essential to overall performance and revenue.

CMOs are increasingly looking and under pressure to see which channels work and which channels are most cost effective.

As marketers, we all like to know where our traffic comes from.

Whether organic, paid, social media or other methods, this information tells us where most of our customers are located and/or where marketing efforts generate the most buzz.

But this is not the whole story.

Conversion rates can be a better indicator of success and let you know where the best opportunities lie.

Let’s say 75% of your traffic comes from organic marketing and 25% from PPC. But your PPC conversion rates are double your organic conversion rates.

What you learn from this is simple: invest more in PPC. If you can increase your PPC traffic to match membership, you’ve just doubled your ROI.

Attribution reports also help you understand how channels interact and which channels can influence others through conversion optimization.

6. Conversion rates by device

Just like checking conversion rates by channel, you’ll want to do the same by device.

If conversion performance is lackluster for one device, it may be time to reinvest in that area, especially if you see an increase in traffic for that device.

Mobile is an excellent example of how device transformations can happen, and conversion rates will vary depending on the device.

This is especially true for e-commerce and retail marketers, as more and more people are buying via mobile and tablet devices.

7. Exit rate

How many visitors leave your website from a particular landing page?

Your website analytics should give you a set number of exits from each of your landing pages.

It may also give a percentage that is the number of exits/pageviews the landing page received.

Use the highest number of exits or the highest percentage exit rate to identify landing pages that need conversion rate optimization and additional stability optimization.

8. Blog click-through rates

Blogs are a great way to showcase your brand and thought leadership and drive traffic to your site, but what do you do with that traffic?

While blogs have notoriously high bounce and exit rates, that doesn’t mean you have to succumb to those ridiculously worthless numbers.

Instead, use them to set goals to drive traffic from your blog to your main site.

A small increase in blog click-through rate can provide valuable new business with almost no additional marketing costs.

9. Customer Lifetime Value

You can’t truly understand the return on investment of your marketing efforts until you have a good idea of what the average customer will spend over their lifetime.

Say, for example, that it costs you $500 to bring in a sale or a new customer. But they only bought $500.

Well, that seems like a net loss once you consider the cost of everything else other than your marketing investment.

But what if you knew that this customer would continue to spend $500 every six months for the next five years?

The average lifetime value for that customer is $5,000.

Now, $500 to get that client doesn’t sound so bad, does it?

LTV = Average Revenue Per User (ARPU) x 1/Churn

This doesn’t mean that you want to lose every first-time customer, but if the initial investment brings in a huge long-term profit, you can more easily count that first sale as a marketing expense, knowing that the profits are to come.

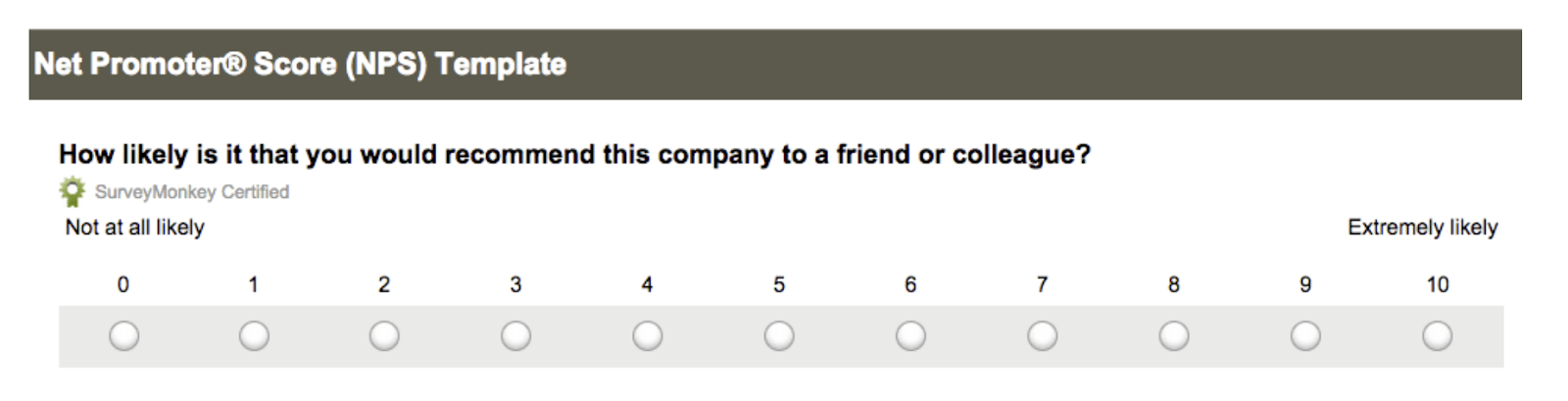

10. NPS

Net Promoter Score (NPS) is a metric by which customers indicate whether they would recommend a product or service to other people and companies.

-

Screenshot from SurveyMonkey, August 2021

Screenshot from SurveyMonkey, August 2021

Based on a scale of 1 to 10, the scores given are a good indicator of customer loyalty and satisfaction.

NPS = % promoters v % detractors

Tracking promoters against detractors (customers who have left or are considering going) helps you measure and improve your customer service strategies and tactics.

11. Time invested in project/campaign vs. yields

Do you know how much time each person in your organization has invested in a particular project or campaign?

If you want to get the most out of each employee’s expertise, you need to make sure they are working on projects that are worth their time.

For example, if you have programmers ranging from beginner to expert, who would you want to work on the projects that bring the highest return in your organization?

Expert level programmers, of course.

Once you know the value of your projects, you can assign the right people to the right projects.

12. Traffic to lead ratio

An increase in website traffic is a positive sign of success for your digital marketing campaigns. But do these results actually affect your company’s bottom line?

Another way to determine the value of your marketing campaigns is the traffic to lead ratio. This KPI simply measures the percentage of your visitors that convert into leads.

For example, let’s say your website has 5,000 visitors this month. 500 visitors converted to the lead. For the month, you will have a 10:1 traffic to lead ratio or a 10% conversion rate for your visitors to leads.

13. ROAS

Measuring return on ad spend helps determine how well your advertising and paid campaigns are performing.

Digital marketers can see that they spent X and got Y.

This is especially important when reviewing performance, comparing channel spend, and forecasting the future.

Most marketers operate on the rule that you should have a 3x return on your investment.

14. Gross Revenue

As marketers, we are constantly challenged with comparisons of sales performance.

- When you lead, sales are the star, and marketing isn’t mentioned much.

- When sales aren’t going well, marketing suddenly gets more signals.

Try to avoid these conflicts by measuring and attributing everything you do.

This could be an entire campaign, a marketing touch or assistance, or an asset.

Ensure that your marketing and sales team has synergy in tracking and reporting final revenue.

Agree on rules and accountability pathways for leads, opportunities, and any marketing activity that impacts or impacts sales revenue.

15. Customer retention rate

Do you know how to measure the number of clients your business has retained?

To calculate the customer retention rate over a specific period of time, use the following formula.

Customer retention rate = ((E – N) / S) x 100

For the time period you are analyzing, you will use the number of customers the period ended with (E), the number of customers you acquired during the period (N), and the number of customers the period began with (S).

Let’s say you start a quarter with 200 customers. This quarter, you gained 35 clients and lost five.

Your formula will look like this:

97.5% = ((230-35)/200) x 100

conclusion

Regardless of your industry and type of business, “What is the return on investment?” is the question all CEOs and CEOs will be asking this year.

As digital marketing grows and adoption increases, so does the pressure to deliver results.

Use the numerical metrics identified in this article and let the data tell the story of your return on investment.

More resources:

- 3 important ways research data can fuel your business

- Content KPIs to determine success at each stage of the conversion path

- Basic Web Basics: A Complete Guide

Featured image: Grayscale Studio/Shutterstock