New Netflix Ads Tier Comes With An Unpredictable Price

The opinions expressed in this story are those of the author only and do not reflect the opinions and beliefs of Search Engine Journal or its affiliates.

With economic challenges looming, consumers are looking everywhere to save money.

After receiving consumer opposition from raising its subscription prices, Netflix introduced its newest category: Basic with Ads, in November 2022.

An ad tier subscription is $6.99 per month – approximately 55% less per month than their standard subscription.

While the monthly cost is lower for consumers, the newer category comes with hidden price tags.

Unexpected announcement timing

In the new Netflix Basic with Ads category, users can expect about 4-5 minutes of ads per hour.

How does it compare to other connected TV subscriptions?

While the amount of ad time per hour for Netflix is comparable to other streaming services, the lingering problem is when An advertisement will appear. Ad times are unpredictable, which hinders user experience.

The video content of the ads is about what you would expect compared to other streaming services. But the same case at hand – when Will this show up in the user’s viewing experience on Netflix?

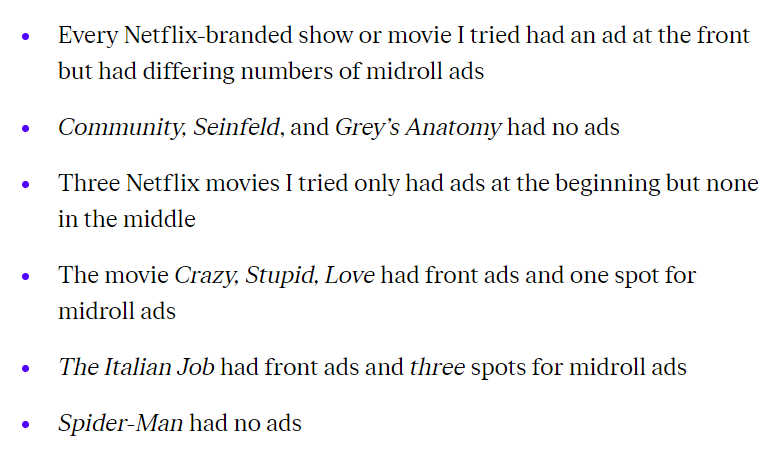

to me Jay Peters from the edgeUser ad experience varies widely between types of content consumed:

Photo credit: Jay Peters, TheVerge.com

Photo credit: Jay Peters, TheVerge.comAs you can see from this example, the amount of ads, as well as the placement of ads, is inconsistent, which leads to the belief that Netflix is testing to find the best interaction for not only users but advertisers.

Certain titles come at a premium price

The second nuance with Netflix Basic comes with the ad layer from the shows and movies served at this level.

Similar to the unexpected advertising experience, the titles available at the basic level seem very scattered without rhyme or reason.

The restriction should come as no surprise to users, like Netflix announce This back in July.

Addresses that are not available to primary users will show a red padlock indicating that they are restricted.

The red lock appears to be a passive “call to action” because users can click on the locked title, which takes them to an upgrade screen.

I assume that the strategy of Netflix subscribers is to attract new users to the service or to get previous subscribers back at the base price level. This can help increase and expand subscriber numbers after a dip since the price increase.

Once the user is in, restricting addresses that may be “essential” to users tries to show users the value of an upgrade.

How can advertisers anticipate connected TV engagement?

Connected TV advertising is nothing new to consumers. Brands spent more 400 million dollars in ads on Hulu alone in 2021.

In a situation of economic uncertainty, consumers may be willing to sacrifice their viewing experience to include advertising while trying to save money. But if the viewing experience diminishes, consumers may be less inclined to engage with connected TV ads.

Although it’s too early to talk about Netflix Basic with ads, a common problem from consumers on other streaming services is lack of diversity in ads.

Again in 2021, Morning Consult conducted a vote To consumers about their experience with advertising for streaming services. According to the survey:

- 69% of users thought the ads they received were repetitive

- 79% of users were annoyed by this experience

So, what does this mean for advertisers?

Depending on how you look at it, marketers could see this as:

- chance. If there are a lot of recurring ads, it may mean that the competition is low on Connected TV/OTT. If this is the case, the brand awareness opportunity may be more cost effective for you before the OTT market gets too saturated.

- sign to turn away. If streaming services don’t fix the consumer’s viewing experience, users are less likely to interact with ads. And if addresses are restricted at a higher rate, consumers may explode at a faster rate than before. This, in turn, means a higher cost of participation for advertisers. This could be a riskier investment for brands with limited budgets.

summary

Netflix’s latest price tier allows them to compete with other streaming services at a lower price point. It’s an excellent strategic move on their part, and it opens up the OTT space for advertisers to stand in front of users who may not be using other streaming services.

While the type of plan is new, Netflix (as well as advertisers) must closely monitor user interaction and establish any strategic pivots necessary to increase engagement and subscriber growth.

While Netflix ads are open to larger advertisers, I expect them to roll out a similar in-house advertising system to Hulu sometime next year.

Have you tried TV/OTT Connected Ads yet? What was your experience? Are they worth the investment?

Featured image: Koshiro K / Shutterstock

![Identity & Custom User Experiences – How ID Helps Convert [Podcast]](https://altwhed.com/wp-content/uploads/2023/02/Identity-Custom-User-Experiences-–-How-ID-Helps-Convert-390x220.jpg)